Short story:

Fed Chair Powell spoke this morning at Jackson Hole where he broadcast an intention to bring down interest rates. This comes after the release of the last FOMC meeting minutes on Wednesday, which pointed to the same thing. In the main, no surprise. Still, markets are enjoying the news. Economically sensitive equity sectors are up sharply this morning. Bonds are up a little bit from yesterday’s close. The conversation is now just about 25bps or 50bps.

Longer story:

The higher for longer narrative is officially dead. In his comments JP made clear he thinks that the balance of risk has changed. Worries about the labor market are now equal to those around inflation. They want to head off further rises in unemployment by moving rates lower in September.

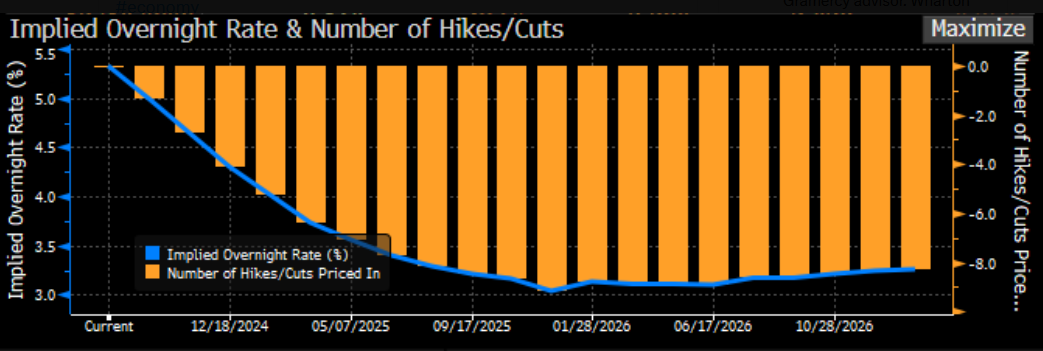

He didn’t clearly hint at how rapid the cuts will be. Some of the recent speeches made by Fed governors give me the impression that they’re aiming for a methodical ratcheting down, without a lot of urgency. This points towards 25bps or perhaps a 50bp followed by 25bps thereafter. The market is currently pricing in a total of around 100bps from here to year end, as you can hopefully see below. Markets are pricing in a full ‘normalization’ of rates ty the end of next year.

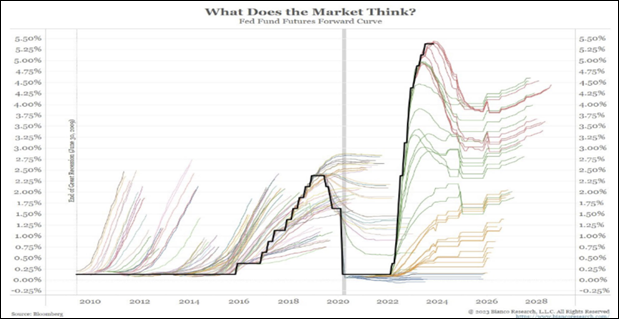

Of course, you all know that the bond market doesn’t always do a good job of predicting the path of interest rates and have seen some version of the chart below. So, we should take the consensus as a gauge of expectations rather than some kind of truth.

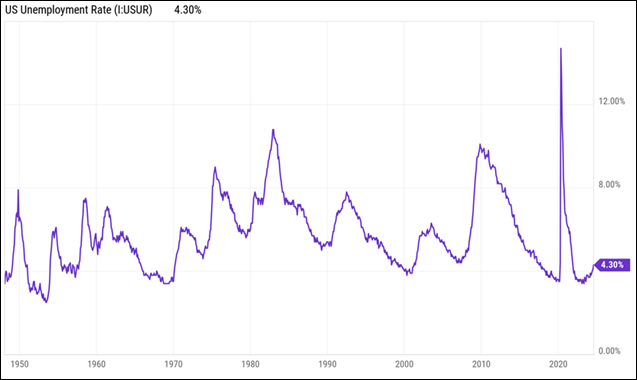

The argument for slow and steady 25bp cuts is that the economy is still growing, and that the accelerating unemployment number is at least partly a result of high rates of immigration, rather than layoffs. So, they may be discounting the unemployment trend a bit. Lastly, this has been more of an income-driven expansion, rather than a credit-driven expansion and there is a tendency for these kind of expansions to persist longer. Something has to dent asset prices substantially to abruptly slow the spending and investment that’s behind current economic growth.

The argument for faster or deeper cuts is a little less complicated. Historical patterns simply show that once unemployment gains momentum (however you want to measure it) it tends to continue to do so, almost exponentially. That rise is in unemployment is associated with recession. The impact of rate cuts takes time and you need to move early and decisively to get out ahead of a recession.

As an aside, this shift in stance by the Fed is already being painted as a partisan maneuver. The comment section of the WSJ can give you the vibe. It’s a cheap shot if you ask me. The Fed can’t just stop doing their job for a long period of time around elections. They’ll come under fire no matter what they do, particularly from the Trump campaign, which want’s very low interest rates, but only if and when Trump is elected. They argue that the Fed is tainted by political influence, but their plan is not to ensure its independence but rather, to erode or eliminate it.