Short story:

The yield on the 10-year treasury has continued rising, now standing at just shy of 4.2%, and some analysts are revising expectations for yields upwards. From the low, yields have now risen 60bps. This kind of “backup” in yields is unusual in an easing cycle. Explanations run the gamut, but we believe it reflects increased odds of a Trump victory in November.

Longer story:

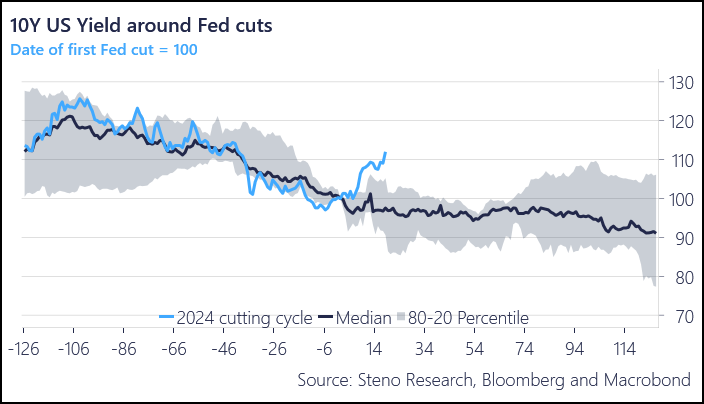

This is quite a rise in rates, versus what we typically see once the fed starts cutting, as you can see below. What gives? If we know that the path of short-term rates is lower from here, that should also be reflected in medium and longer-term rates, to some extent. The Fed only directly controls the short end of the yield curve. But even if long yields don’t fall as fast as short yields and a steepening occurs, we wouldn’t necessarily expect higher long yields in absolute terms.

The market is telling us that something is happening that may result in higher interest rates in the long run, despite the Fed cuts. What can that be? The first answer is: inflation. Inflation expectations have been rising since early September. Why?

Possibilities include:

- Above-trend economic growth

- Supply-side shocks (e.g. bad geopolitics)

- Increased spending (e.g. larger government deficits)

- Over-easy monetary policy (e.g. cutting too much or too early)

Markets generally don’t react strongly to what’s already known to be happening. What they care about is change at the margin. It’s true that economic growth has been surprising to the upside lately, and it’s also true that the total debt load in the US has been getting more attention, because it’s hit certain scary-big round numbers. It’s also true that the improving outlook for growth may call into question an aggressive rate cutting agenda. But, none of this is really news, per se. The easiest explanation is that the market is beginning to price in a second Trump presidency.

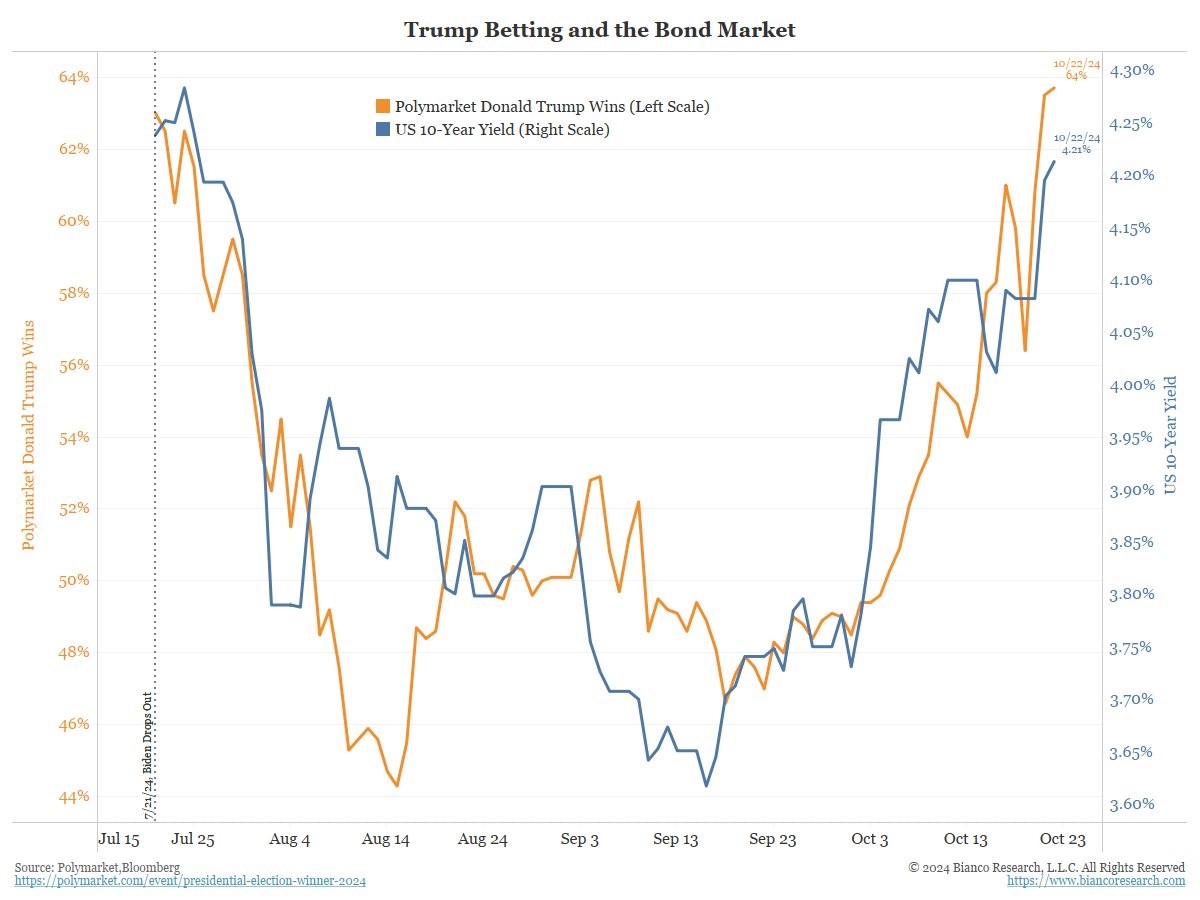

Here is why you can so easily link Trump to higher yields. Tariffs immediately cause goods inflation (immediately!). Tax cuts immediately lead to larger deficits (a kind of stimulus) which both gooses the economy, accelerating growth AND worsens our national debt problem. If inflation is going to run hotter and the national debt grows even more quickly – you might not be as excited to own long bonds. I’ve said before that Trump is better for stocks and Kamala better for bonds, and it looks like we’re getting an early preview of that. The tracking between Trump betting odds and the 10-year yield is uncanny. See below.

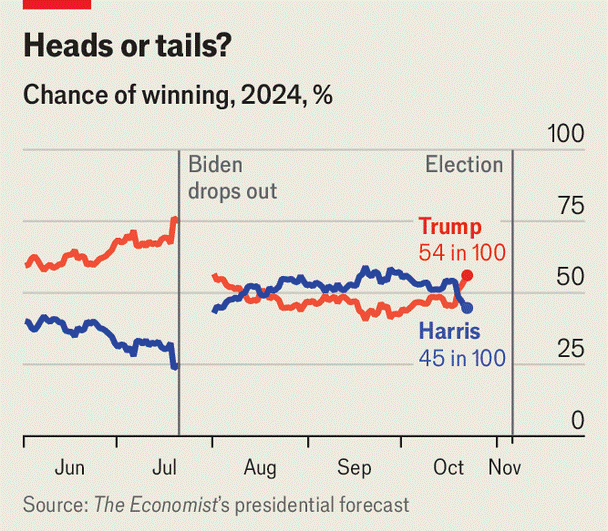

True, the betting odds reflect a fairly thin market, vulnerable to manipulation, but rising odds for Trump are supported by a variety of sources, including The Economist, which has a pretty complex model that doesn’t rely exclusively on polls, which we know to have deteriorated in quality over the last decade or so. It’s still a toss-up, but it doesn’t quite look like 50/50 odds anymore.

Disclosure: This material is for general information only and is not intended to provide specific advice or recommendations for any individual.